- Total long-term mutual funds saw net cash outflows of around $1.5 billion for the two weeks ended September 18, with equities seeing large net outflows. It was largely offset by positive net inflows in bond funds.

- Investors withdrew a net $17.2 billion from equity mutual funds during the two-week period, with domestic and large-cap equities seeing the largest outflows. Meanwhile, total bond funds saw $17.3 billion in net inflows, and hybrid mutual funds saw net outflows of around $1.6 billion.

- U.S. President Donald Trump faces the prospect of impeachment after Democratic House Speaker Nancy Pelosi launched a formal inquiry into the matter of Trump pressuring a foreign leader to investigate Joe Biden’s business dealings in the Ukraine for political gain. Biden, a former Democratic vice-president and a critic of Trump, is largely seen as having the biggest chance of winning the Democratic nomination for president in 2020.

- Germany’s ZEW economic sentiment improved from negative 44.1 to 22.5. Although an improvement, this was the fifth consecutive month of contraction.

- The U.S. Federal Reserve again cut interest rates to 2%, but some policymakers dissented on the decision. Two officials said the U.S. central bank should have kept interest rates unchanged at 2.25%, while a third one, James Bullard, believes the bank should have decreased rates by 0.5% to insure against further declines in inflation. Trump, who favors more aggressive rate cuts, criticized the Fed’s decision.

- The Bank of Japan has kept its monetary policy steady but signaled further easing in October as it fears a potential slowdown in the global economy. The central bank kept its overnight interest rates at minus 0.1% and its target for 10-year bond yields at zero percent.

- The Bank of England decided to keep interest rates unchanged at 0.75%, with the monetary policy committee unanimously voting for the move. However, the bank strongly hinted that it may cut interest rates due to Brexit uncertainty.

- Germany’s flash manufacturing purchasing managers’ index (PMI) declined to 41.4 from a record low of 43.5, the lowest level since June 2009, when the economy was recovering from the financial crisis. Meanwhile, Europe-wide manufacturing PMI declined to a nearly seven-year low of 45.6.

- U.S. core durable goods orders rose 0.5% in August compared to the previous month, beating expectations of 0.2% growth. Overall, goods orders increased by 0.2% versus a decline of 1.1% expected by analysts.

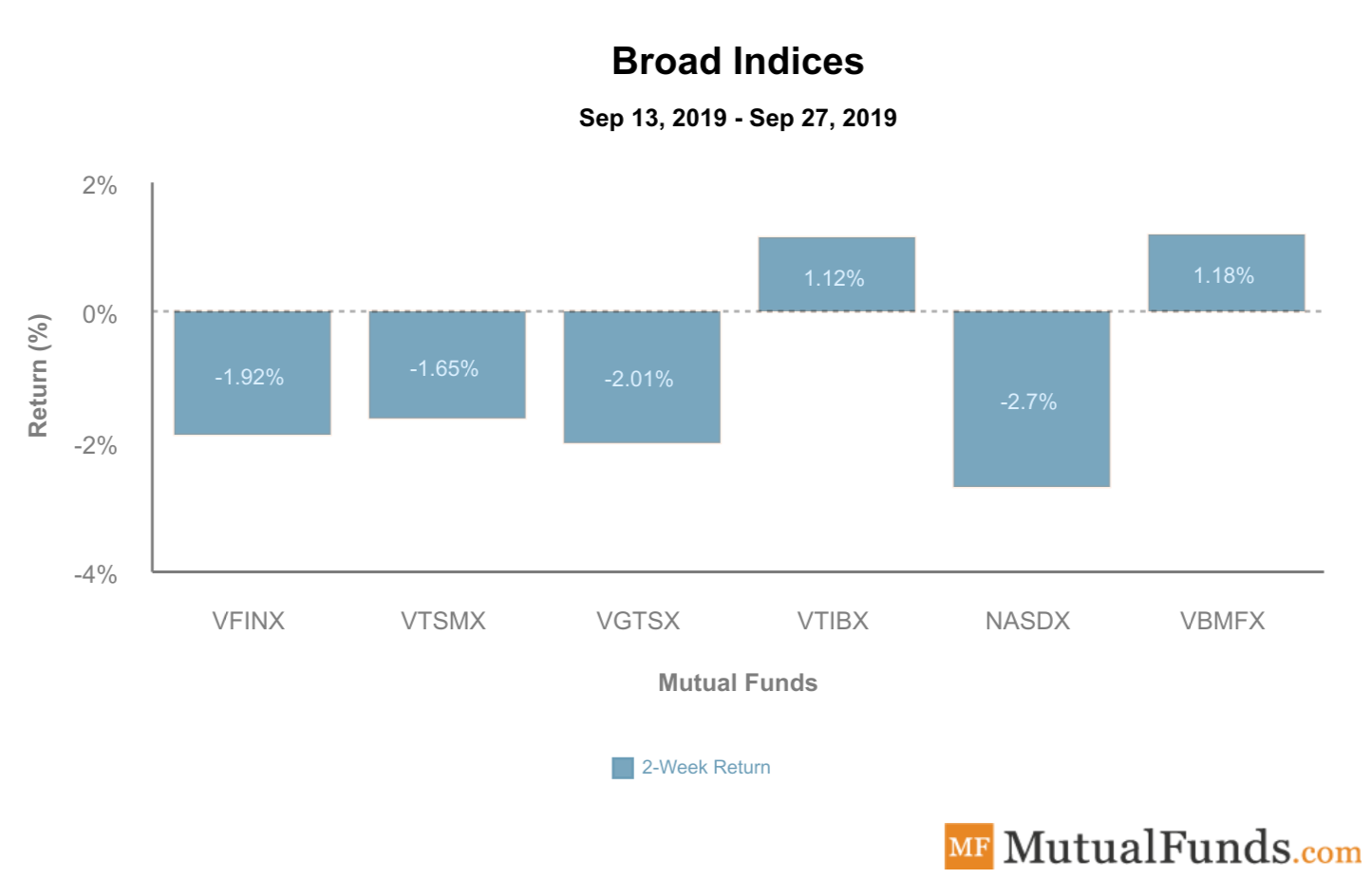

Broad Indices

- The performance of equities and bonds diverged over the past two weeks.

- The U.S. Nasdaq 100 fund (NASDX) saw the biggest decline, losing 2.7%.

- Meanwhile, Vanguard’s total bond market fund (VBMFX) gained 1.2%, the best performance from the pack.

Major Sectors

- Sectors were largely down.

- Vanguard’s telecommunication services sector fund (VTCAX) dropped more than 4% for the past two weeks, becoming the worst performer.

- At the same time, utilities sector fund (FKUTX) gained the most these past two weeks, up 3.3%, as investors favored safe-haven assets in the face of increasing macroeconomic and political uncertainty.

Foreign Funds

- Foreign funds posted widely disparate performances, with India by far the best performer and China on the other end of the spectrum.

- India equities fund (WIINX) surged nearly 8% after the country’s government decided to scrap a tax increase.

- Chinese equities fund (MICDX), meanwhile, declined nearly 5% for the past two weeks.

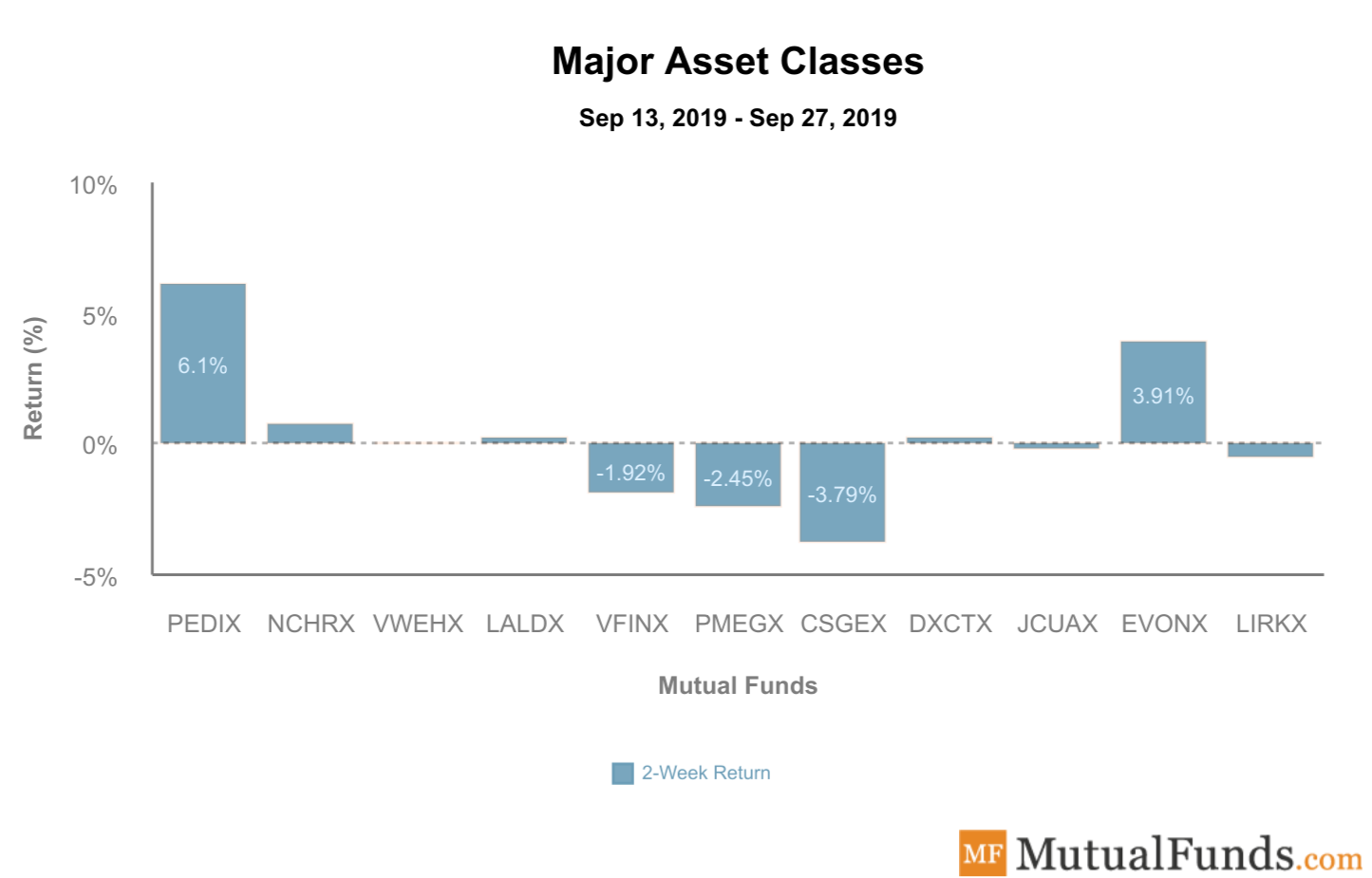

Major Asset Classes

- In asset classes, bonds and managed futures have outperformed equities, as investors flocked to safe-haven assets.

- PIMCO’s long-term bond fund (PEDIX) was the best performer from the pack with a gain of more than 6%.

- At the other end of the spectrum, BlackRock’s small-cap fund (CSGEX) lost 3.8%.

The Bottom Line

Be sure to sign up for your free newsletter here to receive the most relevant updates.